Business

Business

Kerala opposes uniform lottery GST in Council meeting

The issue of uniform Goods and Services Tax (GST) on the face value of lotteries in India has been receiving a few extra ears. Many stakeholders of the industry have taken this issue up with central and state authorities in the past and since then, the GST Council has held meetings, but this issue never received a final say.

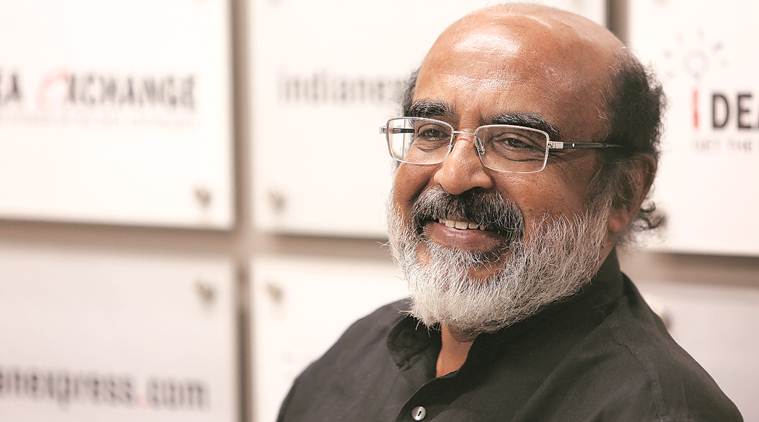

The GST Council formed a Group of Ministers (GoM) consisting of several State Finance Ministers and they considered at length about the implementation of uniform GST rate on lotteries. The group too recommended uniform GST to the GST Council in a unanimous decision, minus three members, led by Thomas Isaac (pictured below), Kerala Finance Minister.

Isaac even made a Facebook post in Malayalam in which he said, “Kerala will fight tooth and nail against any move to change the current lottery system. We are sure that other opposition states will be with us. A fair share of BJP-ruled states, which do not have lottery, will not have any interest on the recommendation. Hence, we can resist this in the next meeting.”

Isaac spoke to Business Standard about this, “We are expecting at least 11 states to support our stand and I hope that the decision can be made through consensus.” He commented after the 24th February GST Council Meeting, “Substantial issues on which there are differences of opinion should not be decided through video conferences of the GST Council. This was the consensus reached in the first council meeting. Finally, good senses prevailed.”

Kerala relies on the lottery revenue for its social welfare programs, which are quite successful. In 2014-15, the state lottery turnover was INR 5,44.84 Crores, which went up to INR 9,021.36 Crores in 2017-18. In 2019-20, the figure is expected to increase to INR 11,863 Crores, according to the state budget.

“We have been able to attain this in lottery sale by strictly defending undesirable trends and preventing the entry of other states’ lotteries. The state government has taken a stand to impose GST at a higher rate on lotteries being conducted by middlemen,” Isaac elaborated on this point.

Arun Jaitely, Union Finance Minister and chairman of GST Council, in the 24th February meeting, was wary of voting on the issue, having previously made all decision only after a consensus had been reached. While no consensus was achieved here, he referred the matter again to GoM for further discussion and told them to come back on 15th March on the next council meeting.

The implementation of uniform GST on lotteries does not seem to be a priority for the BJP government, especially when General Elections are coming up which would obviously take much of the resources and attention of the government. The fate of GST on lottery is still in the Council’s hands but since Jaitley is keen on taking a decision only after a consensus, the industry stakeholders would have to wait for a while.

Keep reading GutshotMagazine.com for more such industry updates and for general gambling/gaming related news from around the world.

Check out our online poker rooms section, where you can read reviews on the biggest and best poker rooms in the country, while also taking advantage of their bonuses and promotions. Check out these top poker rooms HERE.

Top 15 Poker Rooms

-

WPT Global

Grab your welcome offer

Offer: 100% of your deposit back up to $3,000 Register -

PokerDangal

Sign up with code GUTSHOT1

Offer: Get 100% GST discount on deposits Register -

Natural8 India

Sign-up with Gutshot

Offer: Get extra 28% on all deposits Register -

Spartan Poker

Sign-up with referral code AFFGSMAG

Offer: FTD 50% Bonus Money up to ₹20K. Deposit code ‘ALLIN50’ Register -

Junglee Poker

Sign-up and get bonus

Offer: Up to ₹50,000* Register -

Calling Station

Sign-up with promo code 'AFFCSGUT'

Offer: 30% FTD bonus with code FTD30 Register -

WinZo Poker

Daily Winnings Up To ₹40 Crore!

Offer: Get ₹550 Joining Bonus For Free Register -

Stake Poker

Welcome bonus

Offer: 200% up to ₹120,000 Register

Newsletter

Thank you for subscribing to our newsletter.

This will close in 20 seconds