Gaming

Gaming

IT Notices Sent To Online Gaming Winners Says CBDT Chief

Central Board of Direct Taxes Chief Nitin Gupta claims that over ₹58,000 Crore has been won in prize money through online games in the past three years. And hence, the income tax (IT) department has started issuing notices to players who have played and won real money prizes via online games.

The notices are being sent to alert the winners on tax compliance dashboards if there is a deviation in the income and taxes paid. “We have mounted an action in this (online gaming) sector and determined that ₹58,000 Crore winnings were there in the last three years. The data is with us. We are in the process of issuing notices,” Gupta said.

He added that the notices are being displayed on tax compliance portals, and the players are being nudged to look into the matter. The players are expected to pay the taxes voluntarily. Additionally, the IT department is undertaking enforcement actions wherever they find evidence and only then notices are issued.

ALSO READ: Gameskraft Slapped With A ₹20,989 Crore Tax Notice

This comes shortly after the GST intelligence department issued a show-cause notice to Bengaluru-based gaming firm Gameskraft Pvt. Ltd. The department demanded close to ₹21,000 crore including tax, interest and penalty. The department stated that a tax of 28% is applicable to Gameskraft and that the firm was not issuing invoices to the customers which violated Section 15(3) of the CGST Act, 2017.

The Karnataka High Court will hold the next hearing for the case on 11th October 2022, post the Dussehra holidays. The online gaming portal has asked the court for a stay during the hearing. The stay was objected to by Additional Solicitor General (ASG) N Venkataraman, representing the GST authorities.

Gameskraft has approached the Karnataka High Court in the matter. As per news reports, the GST department calculated the taxes on the basis of 28% GST levied on online gaming. As per existing laws, games of skill are expected to pay 18% GST, while games of chance must pay 28% tax.

For more news and updates, keep reading GutshotMagazine.com. Follow us on our social handles Facebook, Instagram, Telegram, and Twitter.

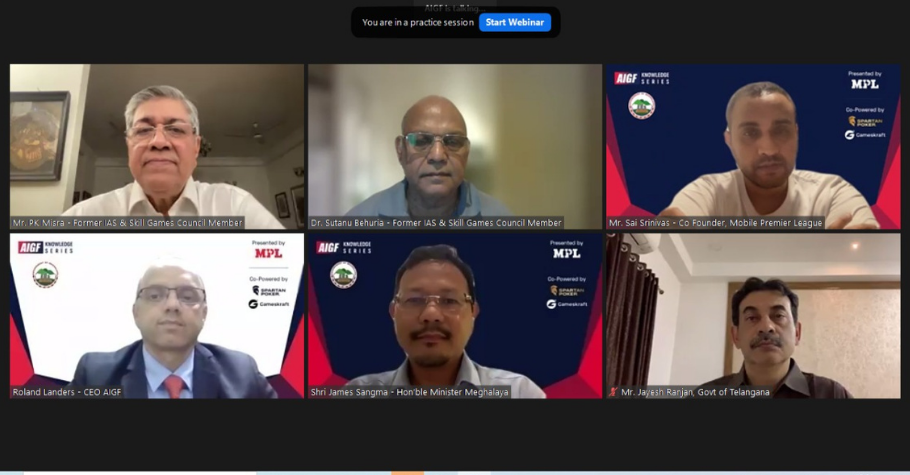

Photo credit: Business Standard

Amarylisa Gonsalves is a Content Writer at Gutshot Magazine. Advancing from a marketing background, she found her calling in writing. She takes delight in exploring genres and is a curious learner. Patient and ambivert, she believes in letting her work speak for itself. Apart from content writing, she finds solace in writing poetry by expressing herself through words. Additionally, she adores indulging in anything that satisfies her creative self, like drawing and DIY crafts.

More News

Comments

Top 15 Poker Rooms

-

PokerDangal

Deposit with code GSTREFUND

Offer: Get 100% GST discount on deposits Register -

Natural8 India

Sign-up with Gutshot

Offer: 200% bonus up to ₹81,000 on first deposit Register -

Spartan Poker

Sign-up with code "GUTSHOT"

Offer: First deposit bonus up to 300% Register -

Junglee Poker

Sign-up and get bonus

Offer: Up to ₹50,000* Register -

BLITZPOKER

Deposit ₹200 with code 'FTDGSB' for 100% bonus

Offer: Register -

BatBall11 Poker

Sign-up with code GUTSHOT

Offer: Get ₹50 FREE Register -

WinZo Poker

Daily Winnings Up To ₹40 Crore!

Offer: Get ₹550 Joining Bonus For Free Register -

PokerSaint

Sign-up with code "GUT100"

Offer: Get ₹50 FREE (post KYC) Register

Leave a Reply