Gaming

Gaming

Nirmala Sitharaman Clarifies On ‘Prospective’ Levy Of 28% GST

Update:

As per the latest update from Union Finace Minister, Nirmala Sitharaman, the 28% GST levied on online gaming, horse racing and casinos will be applicable prospectively from 1st october 2023. She did not comment on tax collection retrospectively which has been widely discussed as many online gaming brands were sent tax notices.

As per media reports, Sitharaman said the following about GST (Second Amendment) Bill, “A clarification on that levy was issued and according to that 28% is the tax. Whom it will apply to and on whom will the incidence fall has been clearly explained. But, about this particular point on valuation rules, I would like to put on record that the valuation rules to exclude winnings are prospective. So, I hope there is no confusion on that.”

She further added, “Valuation of supply of online gaming and actionable claims in casinos may be done based on the amount paid or payable to or deposited with the supplier or on behalf of the player, excluding the amount entered into games based on the winnings of previous games.”

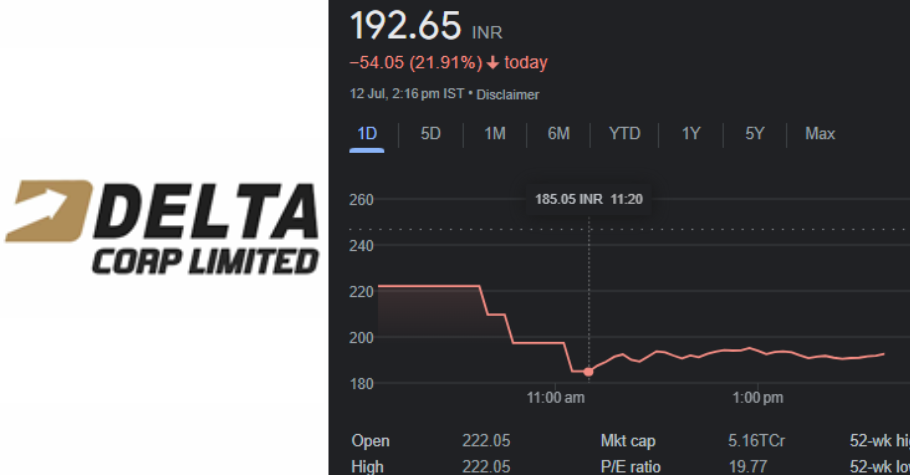

On 11th July the GST Council headed by Nirmala Sitharaman raked up a storm by announcing the imposition of 28% GST on face value of online gaming, horse racing and casinos. This led to unrest in the entire gaming community. The 28% GST on the face value in online gaming is so burdensome for the industry that it could possibly even kill the online gaming industry.

In an official statement, the Finance Minister said, “Our agenda is not to end any industry… all types of businesses have to function… There was discussion on the moral question that, on one front, you do not want to end an industry. But that does not mean that you give more incentives to them than essential goods… all states participated in this decision which has been pending for the last 2-3 years. We could take the decision because every state clearly participated in it.”

After facing opposition from the companies as well as investors, the GST Council decided to meet again to work on the issue. Likewise, the GST Council chaired by the Finance Minister will meet today, 2nd August 2023, to discuss the matter further and come to a resolution.

28% GST On Online Gaming Final Decision EXPLAINED!

7.33 PM – 28% GST On Face Value Upheld

The Finance Minister announced that the Council upholds the 28% GST on face value. Nirmala Sitharaman said, “Valuation of supply of online gaming and supply of actionable claims in casinos, the council recommended that the supply of online gaming and supply of actionable claims in casinos may be done based on the amount paid, or payable, or payable to, or deposited to the supplier on behalf of the player, excluding the amount entered into games, bets, out of winnings of previous games and bets, and not on the value of the bets placed.”

#WATCH | Union Finance Minister, Nirmala Sitaraman says, "It (28% GST on online gaming & casinos) is expected to be implemented from 1st October… It is also decided that this decision will be reviewed after six months after it is implemented. When I say six months it does not… pic.twitter.com/vBOhCZrv4w

— ANI (@ANI) August 2, 2023

No Change for 28% GST on Online Gaming, Casinos, Horse Racing: 51st GST Council

#GST #GSTCouncil #GSTRate #GSTCouncilMeet

— CA Bimal Jain (@BimalGST) August 2, 2023

7.33 PM – 28% On GGR Is Not Feasible

7:25 PM – Council To Review After 6 Months of Implementation

7:25 PM – The New Amendment To Be Implemented from 1st October Tentatively

7:20 PM – States Express Their Views

The FM of Delhi asked the council to reconsider the 28% GST on face value. The representation from Goa and Sikkim expressed the need for the tax to be on the GGR and not face value. TN had apprehensions on online gaming.

7:15 PM – Watch The Press Conference Live

7:10 PM – Review After 3 Months?

As we await the official announcement from the GST Council, there are speculations on the internet that GST Council will review the tax implications in detail and take the decision in the next 3 months. Will this be true?

7:00 PM – GST Council Meeting Ended

The GST Council’s meeting has ended. People awaiting Finance Minister Nirmala Sitharaman to start the official press conference.

6:40 PM – Press Conference Delayed

The press briefing by Finance Minister Nirmala Sitharaman which was scheduled to be held at 6.15 PM has been delayed. Meanwhile, people are eagerly awaiting the Council’s announcement on the 28% GST on Online Gaming.

Everyone right now waiting for the 28% GST on online gaming update!😂#UnfairGST #GSTCouncilMeeting #SaveOnlineGaming #GST #onlinegaming #gstononlinegaming https://t.co/6eXn8w7l23

— Gutshot Magazine (@GutshotMagazine) August 2, 2023

5:50 PM – Press Conference At 6.15 PM

Finance Minister Nirmala Sitharaman will host a press conference at 6.15 PM to announce decisions of the GST Council Meeting held today.

5:31 PM – Law Committee Submits Draft

The Law Committee, which consists of the centre and state tax officers, have submitted a proposed draft. It states the rules for consideration of the GST Council with regard to the computation of supply value for tax purposes. The committee has suggested the introduction of a new rule. As per the new rule, the value of supply of online gaming would be the total amount deposited with the online gaming platforms by way of money or virtual digital assets by the player. As far as casinos are concerned, the committee has proposed that the supply value would be the amount paid by a player for the purchase of tokens, chips, coins or tickets.

What Does 28% GST On Face Value Mean?

The GST on face value meant that the companies involved in online gaming will have to pay taxes accounting to more than their revenues. In online games, the platforms often charge an entry fee from the user. From this entry fee, a certain amount is deducted by the operator as chargers to run the game, while the rest is accumulated into the prize pool.

For example, an operator charges ₹100 as the entry fee, out of which ₹20 is deducted, and ₹80 is added to the prize pool. This ₹20 is the gross gaming revenue (GGR) or the brands. So far, the operators needed to pay a tax of 18% on GGR, which was ₹3.6.

However, the new announcement stated that companies would have to pay 28% on face value, that is 28% on ₹100, which is ₹28. But that’s not all. Currently a TDS of 30% is already imposed on the final winnings of the user, which means the 28% GST on face value just adds to the tax burden of the players as well .

Meanwhile, #UnfairGST and ‘28% GST’ are trending on Twitter ever since the GST regulation was announced. Here is what the general public and influential people are saying about the government’s decision:

पिछली GST Council की मीटिंग में Gambling, betting वाली Games पर 28% GST का फ़ैसला लिया गया था

लेकिन Online Games इससे अलग है, इस पर 28% GST लगाना ग़लत है

कोई अगर 10 Minute के लिए Chess, Carrom खेलेगा तो उस पर 28% GST लग जायेगा।

इससे 50,000 नौकरियां चली जायेगी

ऐसे में विदेशी… pic.twitter.com/musWJ0MHgv

— AAP (@AamAadmiParty) August 2, 2023

IT Minister of Bihar @IMansuriRJD criticises the 28% GST on Online gaming, saying, "The Finance Minister needs to know that the tax is more than the revenue earned by skill gaming companies."#UnfairGST #GSTCouncilMeeting #SaveOnlineGaming #GST #onlinegaming #gstononlinegaming https://t.co/P2iOiVW0Qp

— Gutshot Magazine (@GutshotMagazine) August 2, 2023

Finance Minister of Delhi @AtishiAAP promises to favour the reconsideration of 28% GST on Online Gaming.#UnfairGST #GSTCouncilMeeting #SaveOnlineGaming #GST #onlinegaming #gstononlinegaming https://t.co/Co2nR5DNtE

— Gutshot Magazine (@GutshotMagazine) August 2, 2023

For more news and updates, keep reading Gutshot Magazine or follow us on our social media handles. We are present on Facebook, Instagram, Twitter, and Telegram.

Gutshot Magazine is India’s leading real money gaming magazine that covers news, updates, previews, highlights, features and much more across verticals like poker, rummy, and fantasy sports. Our rich history that has spanned over a decade now, Gutshot Magazine has always tied up with events and tournaments that have helped push the awareness of skill gaming in the country. If you are looking for the latest updates across real money gaming, then you have arrived at the perfect destination.

More News

Top 15 Poker Rooms

-

WPT Global

Grab your welcome offer

Offer: 100% of your deposit back up to $3,000 Register -

PokerDangal

Sign up with code GUTSHOT1

Offer: Get 100% GST discount on deposits Register -

Natural8 India

Sign-up with Gutshot

Offer: Get extra 28% on all deposits Register -

Spartan Poker

Sign-up with referral code AFFGSMAG

Offer: FTD 50% Bonus Money up to ₹20K. Deposit code ‘ALLIN50’ Register -

Junglee Poker

Sign-up and get bonus

Offer: Up to ₹50,000* Register -

Calling Station

Sign-up with promo code 'AFFCSGUT'

Offer: 30% FTD bonus with code FTD30 Register -

WinZo Poker

Daily Winnings Up To ₹40 Crore!

Offer: Get ₹550 Joining Bonus For Free Register -

Stake Poker

Welcome bonus

Offer: 200% up to ₹120,000 Register

Newsletter

Thank you for subscribing to our newsletter.

This will close in 20 seconds