Poker

Poker

28% GST: New Changes Implemented By Online Poker Sites From 1st Oct

Online poker sites in India have made the necessary changes in accordance to the 28% GST (goods and services tax) levied by the Central governement on full face value of deposits. In August 2023, Union Finance Minister, Nirmala Sitharaman introduced amendments to the Central and GST bills in Lok Sabha, which were to come into effect from 1st October 2023.

The state assemblies will have to pass similar amendments to implement these new changes in taxation. On 11th July, the GST Council had announced their decision to levy 28% on online gaming, horse racing and casinos in the country.

When it comes to online poker sites, many brands have announced how the new regime in taxation will be imposed. Online poker platforms like Adda52, Spartan Poker, PokerHigh, Pocket52 and PokerBaazi have made their respective announcements on how each platform would adapt to the 28% GST. Take a look below.

Pocket52

The below notification was sent to Pocket52 players on WhatsApp.

- After adding cash to your Pocket52 wallet, you will receive 100% as the buy-in amount.

- Your rakeback percentage will remain unchanged.

- Starting 1st October, GST (Goods and Services Tax) will be applied to the add cash amount rather than the commission. To clarify, previously, an 18% GST was calculated based on the commission generated. From 1st October, a 28% GST will be applicable to the add cash amount.

Current rakeback amount before 1st October = (Gross commission – (GST deducted on commission) *rakeback percentage.

Rakeback amount from 1st October = (Gross commission – (GST deducted on add cash) * rakeback percentage

- In situations where the net commission (Gross commission – GST deducted on add cash) is less than 0, the remaining amount will be carried forward to the next month’s calculation.

- Rakeback payments will be processed on a monthly/weekly basis, and you can monitor your progress on the royalty rewards page.

If players have any further inquiries or require assistance they can reach out on this helpline number 1800-121-663322.

ALSO READ: 28% GST On Online Gaming: What It Means For The Players?

Spartan Poker and network partners

The following statement was issued by Spartan Poker and its network partners via email to their respective players.

“To continue with our commitment to give a seamless experience to you, Spartan Poker and its network partners have decided to bear the 28% applicable on all deposits starting 1st Oct 2023 adhering to the notification released by the revenue department of the Finance Ministry on 29th September 2023.

This means every time you deposit, your wallet will be added with the amount requested without any deductions.”

Read below:

- Your Deposit: ₹100

- You will get ₹100 in your Spartan Poker wallet. This will be a combination of ₹78 as deposit + ₹22 as instant real cash bonus

- Spartan Poker will pay the GST amount to the government on your behalf

Example: If user has used any promotional code while making a deposit, they will have to generate 1.5x rake of the bonus received (earlier it was 2.5x) e.g., ₹150 rake to be generated if they get ₹100 bonuses on a deposit of ₹1,000 and if user has not used any code while making a deposit, they will have to generate 7% rake of the deposit amount (earlier it was 2%) e.g., ₹70 rake to be generated on a deposit of ₹1,000.

The above is also applicable for Spartan Poker‘s network partners—PokerHigh, Calling Station and BLITZPOKER.

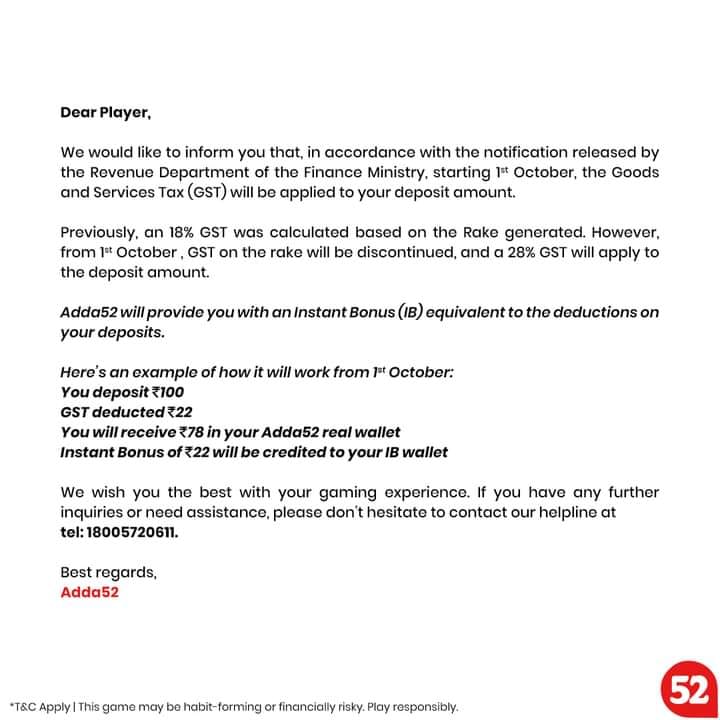

Adda52

Take a look at the Adda52 notification on the new changes being implemented as per 28% GST.

PokerBaazi

The below notification was mailed to PokerBaazi players.

“Adhering to the notification released by the Revenue department of the Finance Ministry on 29th September, the GST changes will be coming into effect from 1st October 2023. This means that 28% GST will be applicable on all deposits starting 1st October.

To continue with our commitment to give a seamless experience to you, PokerBaazi has decided to bear this huge cost. Every time you deposit, your wallet will be added with the amount requested.

Consider the following example:

- You deposit ₹100.

- You will get ₹100 in your PokerBaazi wallet to play. This will be a combination of ₹78 as deposit + ₹22 as Instant Real Cash Bonus.

- PokerBaazi will pay the GST amount (of ₹22 bucks in this example) to the Government on your behalf and you will get an invoice for the same.

We would like you to focus on your game and keep enjoying it on PokerBaazi as you always do while we take this huge hit on us and try our best to sustain the Poker ecosystem in India. Keep playing and supporting us, and let’s together make this game bigger. Wish you the best at the Poker tables!”

PokerNXT

Check out the statement issued by PokerNXT to its players via email.

“Dear Valued PokerNXT patron, we hope this message finds you well. We wanted to inform you about the change in GST regulations, as per the notification issued by the Revenue Department of the Finance Ministry on 29th September, 2023.

In compliance with the changed law, starting from today October 1st, 2023, a 28% GST will be applicable to all deposits made on PokerNXT. Let’s consider the following example:

- You deposit ₹100.

- You will get ₹100 in your Cash wallet of PokerNXT app to play.

- PokerNXT will pay the GST amount (of ₹28 in this example) to the Government on your behalf and you will get an invoice for the same.

We understand that this may raise concerns, but please rest assured that we are committed to providing you with a seamless gaming experience. Please feel free to reach out to support@pokernxt.in for any queries you may have.

In light of this change, PokerNXT has decided to absorb the additional cost on your behalf. When you make a deposit, the requested amount will be credited in full to your Cash wallet on the PokerNXT app. We will handle the GST payment (as illustrated in the example with ₹28) to the Government, and you will receive an invoice for the same.

Our goal is to allow you to focus on enjoying your game on PokerNXT, just as you always have. We are dedicated to supporting and sustaining the Poker ecosystem in India, and your continued support is invaluable to us.

Thank you for being a part of our PokerNXT community. Let’s join hands and work together to make the game even bigger and better. We wish you the best of luck at the poker tables!”

Natural8 India

The below statement was issued by Natural8 India to its players, via email:

“28% GST on deposits effective 1st October 2023. Starting 1st October 2023, a 28% Goods and Services Tax (GST) will be levied on all deposits received for online gaming. Sanctioned by the Central Board of Indirect Taxes and Customs (CBIC), all online gaming operators are required to transition to the new, elevated tax rate.”

As per media reports only 13 Indian states / union territories have made the amendments in the legislature. The remaining states have to still make necessary changes in their respective legislature. Indian states like Goa, Madhya Pradesh, Karnataka and Gujarat are ready to implement the 28% GST levy. Central Board of Indirect Taxes and Customs (CBIC) Chairman, Sanjay Kumar Agarwal was reportedly quoted saying, “We are fully prepared to bring it into effect from 1st October. As per the decision in the last meeting of the GST Council, related notifications are under process. It is necessary for all states to pass the law or bring out an ordinance.”

“Every state needs to give approval because all states’ laws will need to bring in the required provisions, those who are left will have to complete the exercise.”

For more news and updates, keep reading Gutshot Magazine or follow us on our social media handles. We are present on Facebook, Instagram, Twitter, and Telegram.

With a Masters Degree in Journalism and Communication, Mrinal Gujare currently is cruising through an exciting genre of writing and editing at Gutshot Magazine. Apart from being an Editor, Mrinal is an avid reader and a former contemporary dancer. She is also perennially hungry for intriguing scoops from across the globe. No holds barred is the rule Mrinal follows in life.

More News

Top 15 Poker Rooms

-

WPT Global

Grab your welcome offer

Offer: 100% of your deposit back up to $3,000 Register -

Junglee Poker

Sign-up and get bonus

Offer: Up to ₹50,000* Register -

PokerDangal

Sign up with code GUTSHOT1

Offer: Get 100% GST discount on deposits Register -

Natural8 India

Sign-up with Gutshot

Offer: Get extra 28% on all deposits Register -

Spartan Poker

Sign-up with referral code AFFGSMAG

Offer: FTD 50% Bonus Money up to ₹20K. Deposit code ‘ALLIN50’ Register -

Calling Station

Sign-up with promo code 'AFFCSGUT'

Offer: 30% FTD bonus with code FTD30 Register -

WinZo Poker

Daily Winnings Up To ₹40 Crore!

Offer: Get ₹550 Joining Bonus For Free Register -

Stake Poker

Welcome bonus

Offer: 200% up to ₹120,000 Register -

CristalPoker

First Deposit Bonus

Offer: 100% up to €2,000 Register

Newsletter

Thank you for subscribing to our newsletter.

This will close in 20 seconds