Fantasy sports

Fantasy sports

Are Fantasy Sports Players Exempted From Taxes? FIND OUT

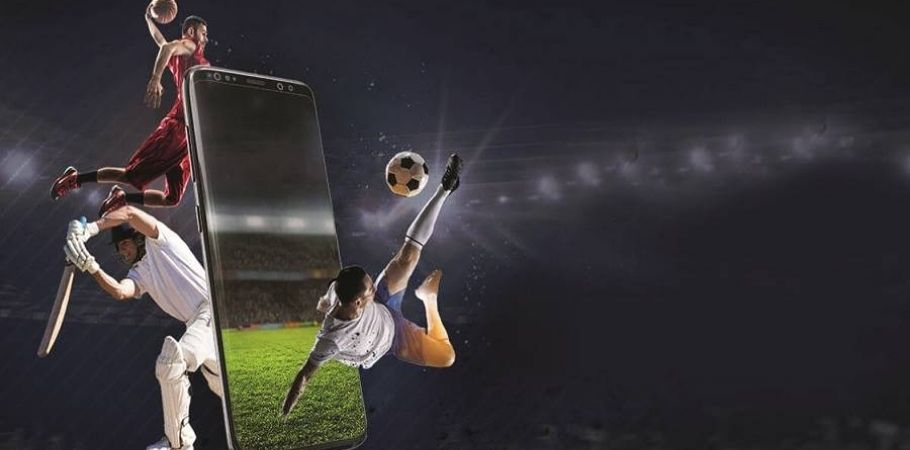

Fantasy Sports is booming in the country. The immense popularity of Indian Premier League (IPL) along with low-cost data plans and the penetration of smartphones in India, the growth of fantasy sport has set new records.

Fantasy sports operators offer games in different verticals like fantasy cricket, hockey, football, basketball, and more. As per a report by the Federation of Indian Fantasy Sports (FIFS), the revenue of fantasy sports operations has increased by 3X in 2020, which amounts to INR 2,400 Crore. The number of fantasy sports users has increased incredibly. The number of users was at 2 Million while in 2020 it touched over 100 Million.

ALSO READ: Approaching Cricket And Fantasy Sports The Unconventional Way

Though this industry boasts of such a strong user base, there are several fantasy sports enthusiasts who are still clueless about tax implications. Winnings from a fantasy sports game is taxable under section 115 BB of the Income Tax Act, commonly known as ‘ITA.’ This comes under the head of ‘Income from other sources and this is a special provision for winnings from crossword puzzles, lottery, horse race, card games among other things.

The winnings are taxed at 30% including cess. The net rate after cess comes upto 31.2% without the benefit of basic exemption limit. The platform that pays you when you win X amount will deduct tax under section 194 B of the ITA if the winnings exceed INR 10,000 per contest. Thus it should be noted that the income tax is to be paid on total winnings. No deduction is allowed based on any expenditure or allowance. So, the amount that you used to enter a tournament will not be deducted when you collect your prize money.

Let’s take an example of the same. If X places a bet of INR 1,000 in a fantasy sports contest on an online platform and wins INR 10,000 as prize money. The amount won, INR 10,000 would be taxable at 31.2%. The process of taxation and the fact that it is under the purview of the government gives more credibility to fantasy sports operators in India.

For more such articles, keep reading GutshotMagazine.com. Follow us on our social handles Facebook, Instagram, and Telegram.

Aakash Mishra is a fantasy writer and prediction aficionado. Being a cricket enthusiast himself, he loves to relate and propagate about how fantasy sports platforms can be advantageous in our day to day life. Along with foretelling match results, he enjoys writing about game forecasts for all fantasy sports.

Comments

Top 15 Fantasy Sports Sites

-

Kubera Fantasy

Use referral code GUTSHOT

Offer: Get Instant ₹100 FREE Register -

PlayerzPot

First deposit on PlayerzPot

Offer: Get 100% bonus up to ₹10,000 Register -

Fantasy Akhada

4% commission on friends' deposits

Offer: Sign-up & get ₹500 FREE Register -

BalleBaazi

Sign-up Now

Offer: Get ₹50 FREE Register -

My11Circle

Download the app

Offer: Get ₹1,500* FREE Register